When you looking for behavioral finance thaler, you must consider not only the quality but also price and customer reviews. But among hundreds of product with different price range, choosing suitable behavioral finance thaler is not an easy task. In this post, we show you how to find the right behavioral finance thaler along with our top-rated reviews. Please check out our suggestions to find the best behavioral finance thaler for you.

Reviews

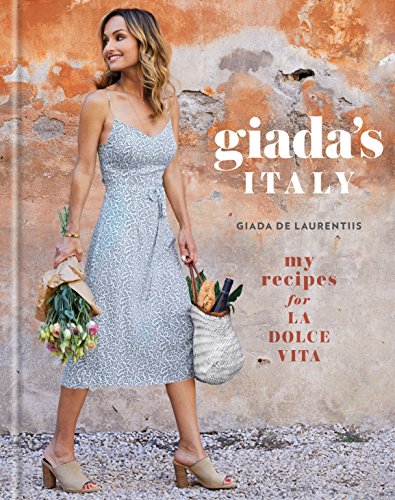

1. Misbehaving: The Making of Behavioral Economics

Feature

Misbehaving The Making of Behavioral EconomicsDescription

Misbehaving is Richard H Thaler s arresting frequently hilarious account of his struggle to bring economics back down to earth and transform the way we think about ourselves and our world Coupling recent discoveries in human psychology with a practical understanding of incentives and market behavior this founding father of behavioral economics Chicago Tribune opens up new ways to look at everything from household finance to TV game shows the NFL draft and businesses like Uber Misbehaving reveals how the study of human miscalculations can help us make smarter decisions in our lives our businesses and our governments Book jacket Richard H Thaler has spent his career studying the radical notion that the central agents in the economy are humans predictable error prone individuals Misbehaving is his arresting frequently hilarious account of the struggle to bring an academic discipline back down to earth and change the way we think about economics ourselves and our world Traditional economics assumes rational actors Early in his research Thaler realized these Spock like automatons were nothing like real people Whether buying a clock radio selling basketball tickets or applying for a mortgage we all succumb to biases and make decisions that deviate from the standards of rationality assumed by economists In other words we misbehave More importantly our misbehavior has serious consequences Dismissed at first by economists as an amusing sideshow the study of human miscalculations and their effects on markets now drives efforts to make better decisions in our lives our businesses and our governments Coupling recent discoveries in human psychology with a practical understanding of incentives and market behavior Thaler enlightens readers about how to make smarter decisions in an increasingly mystifying world He reveals how behavioral economic analysis opens up new ways to look at everything from household finance to assigning faculty offi2. Advances in Behavioral Finance (Roundtable Series in Behavioral Economics)

Feature

Used Book in Good ConditionDescription

Modern financial markets offer the real world's best approximation to the idealized price auction market envisioned in economic theory. Nevertheless, as the increasingly exquisite and detailed financial data demonstrate, financial markets often fail to behave as they should if trading were truly dominated by the fully rational investors that populate financial theories.

These markets anomalies have spawned a new approach to finance, one which as editor Richard Thaler puts it, "entertains the possibility that some agents in the economy behave less than fully rationally some of the time." Advances in Behavioral Finance collects together twenty-one recent articles that illustrate the power of this approach. These papers demonstrate how specific departures from fully rational decision making by individual market agents can provide explanations of otherwise puzzling market phenomena.

To take several examples, Werner De Bondt and Thaler find an explanation for superior price performance of firms with poor recent earnings histories in the tendencies of investors to overreact to recent information. Richard Roll traces the negative effects of corporate takeovers on the stock prices of the acquiring firms to the overconfidence of managers, who fail to recognize the contributions of chance to their past successes. Andrei Shleifer and Robert Vishny show how the difficulty of establishing a reliable reputation for correctly assessing the value of long term capital projects can lead investment analysis, and hence corporate managers, to focus myopically on short term returns.

As a testing ground for assessing the empirical accuracy of behavioral theories, the successful studies in this landmark collection reach beyond the world of finance to suggest, very powerfully, the importance of pursuing behavioral approaches to other areas of economic life. Advances in Behavioral Finance is a solid beachhead for behavioral work in the financial arena and a clear promise of wider application for behavioral economics in the future.

3. 2: Advances in Behavioral Finance, Volume II (The Roundtable Series in Behavioral Economics)

Feature

Advances in Behavioral FinanceDescription

This book offers a definitive and wide-ranging overview of developments in behavioral finance over the past ten years. In 1993, the first volume provided the standard reference to this new approach in finance--an approach that, as editor Richard Thaler put it, "entertains the possibility that some of the agents in the economy behave less than fully rationally some of the time." Much has changed since then. Not least, the bursting of the Internet bubble and the subsequent market decline further demonstrated that financial markets often fail to behave as they would if trading were truly dominated by the fully rational investors who populate financial theories. Behavioral finance has made an indelible mark on areas from asset pricing to individual investor behavior to corporate finance, and continues to see exciting empirical and theoretical advances.

Advances in Behavioral Finance, Volume II constitutes the essential new resource in the field. It presents twenty recent papers by leading specialists that illustrate the abiding power of behavioral finance--of how specific departures from fully rational decision making by individual market agents can provide explanations of otherwise puzzling market phenomena. As with the first volume, it reaches beyond the world of finance to suggest, powerfully, the importance of pursuing behavioral approaches to other areas of economic life.

The contributors are Brad M. Barber, Nicholas Barberis, Shlomo Benartzi, John Y. Campbell, Emil M. Dabora, Daniel Kent, Franois Degeorge, Kenneth A. Froot, J. B. Heaton, David Hirshleifer, Harrison Hong, Ming Huang, Narasimhan Jegadeesh, Josef Lakonishok, Owen A. Lamont, Roni Michaely, Terrance Odean, Jayendu Patel, Tano Santos, Andrei Shleifer, Robert J. Shiller, Jeremy C. Stein, Avanidhar Subrahmanyam, Richard H. Thaler, Sheridan Titman, Robert W. Vishny, Kent L. Womack, and Richard Zeckhauser.

4. Advances in Behavioral Finance, Volume II (05) by Thaler, Richard H [Paperback (2005)]

Description

Advances in Behavioral Finance, Volume II (05) by Thaler, Richard H [Paperback (2005)]5. [(Advances in Behavioral Finance )] [Author: Richard H. Thaler] [Aug-1993]

![Advances in Behavioral Finance, Volume II (05) by Thaler, Richard H [Paperback (2005)]](https://images-na.ssl-images-amazon.com/images/I/21IW3yaOOUL.jpg)

![[(Advances in Behavioral Finance )] [Author: Richard H. Thaler] [Aug-1993]](https://images-na.ssl-images-amazon.com/images/I/41XpZU9VkRL.jpg)